And here we're gonna talk about retirement plans that are geared for small businesses. We're gonna focus on the SEP purses, the simple IRA. I'm gonna go through each one of these plans and hopefully by the end, you'll have a better understanding of which plane is right for your small business. If this is your first time to our channel or you haven't already, be sure to subscribe. My name is Travis Sickle, a certified financial planner with 600 financial advisors. The SEP and simple IRA are two accounts to help you get to retirement. SEP stands for simplified employee pension, while simple IRA stands for savings incentive match plan for employees IRA, individual retirement account. Both retirement accounts can hold the same investments, so you can hold stocks or bonds, mutual funds or ETFs. They're also taxed very similarly. They're taxed just like a 401k or a traditional IRA, and these dollars are gonna go in pre-tax, grow tax-deferred, and come out as ordinary income after age 59 and a half. Now I'm going to talk about the contribution limits with the SEP IRA. They're all employer contributions, so the employer is gonna choose anywhere from 1 to 25 percent of income, and that's what's going to go into everybody's SEP. With the simple IRA, it works a little differently on the employee side. You can put up to $12,500 or if you're 50 or over, you can contribute an additional $3,000. This simple works a little differently where the employee can contribute up to $12,500 or if they're 50 or older, they can have an additional $3,000 catch-up contribution, but that contribution comes exclusively from the employee. On the employer side with the simple IRA, you'll either have a 2% or a 3 percent contribution from the employer...

Award-winning PDF software

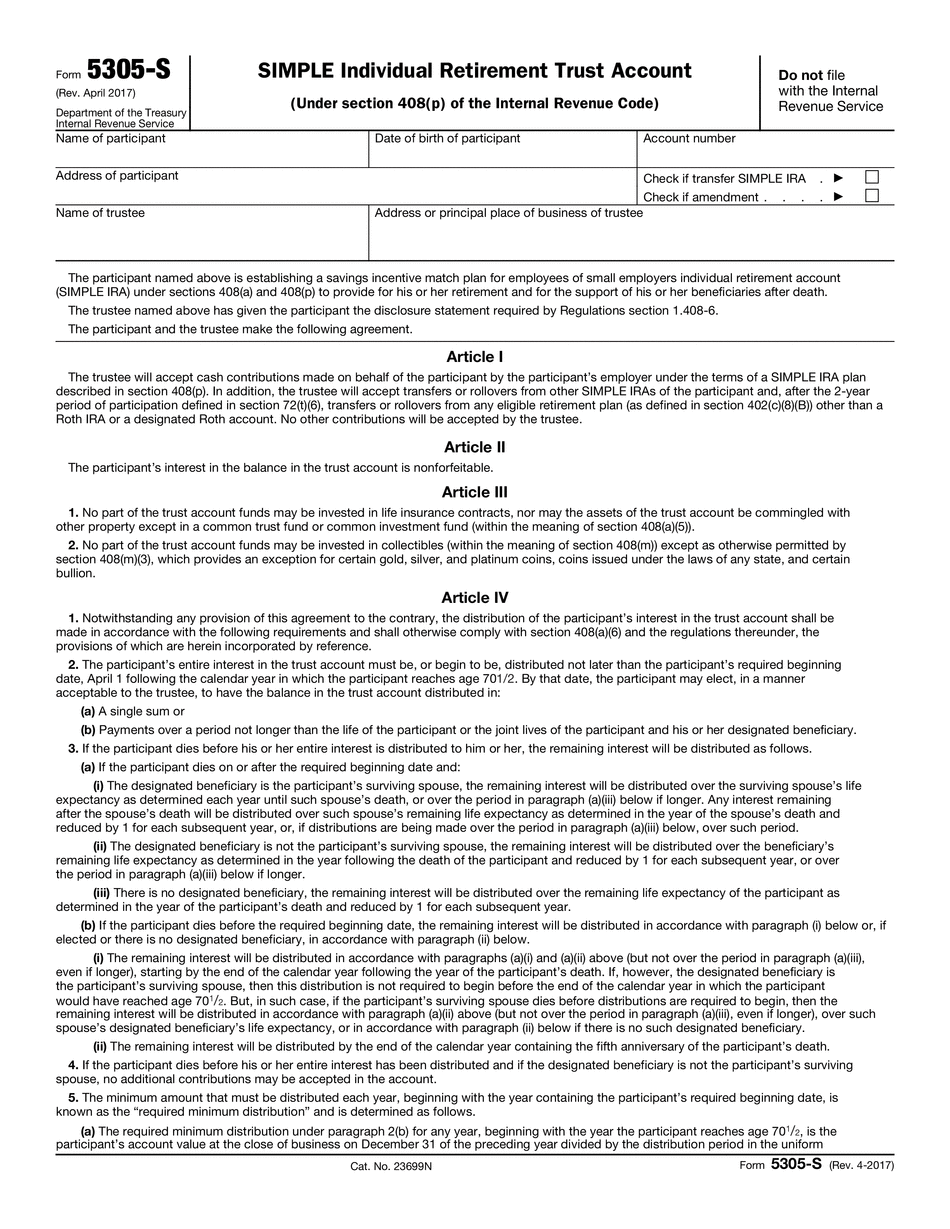

5305-S Form: What You Should Know

Internal Revenue Service, Washington, D.C., 2000. Publication 937. Form 5305-SIMPLE — T. Rowe Price Form 5305-SIMPLE is a model Savings account in the same way as 401(k) (SIMPLE). If you have a Savings plan established at your business, and you are a small employer(employer with less than 51 employees). For more details. Please click on the link and find your plan and make sure it is the savings plan you need. This plan is called SIMPLE or a SIMPLE IRA. 5305-S. Form. DO NOT File. With the Internal. Revenue Service. SIMPLE Individual Retirement Trust Account. (Rev. January 2000) Department of the Treasury. Internal Revenue Service. Washington, D.C., 2000. Publication 937. 6. You have already been denied, or you are looking or know that your 401(k) or 403(b) is for the above. You either have an IRA or a 401k. Furthermore, you only need a single form with a single name. Your only concern is the “401(k) or 403(b)” in the name. 6.1. Go to Your 401k.com. Enter the information in the box on the right. 6.2. Go to Social Security Administration. Enter the information in the box on the left. 6.3. Go to IRS.gov. Enter the information in the box on the left. 7. Check the “401(k)” or “403(b)” to find what you need. You can also look in the guide. This guide is the “C” directory. 8. You know it is for the 401k. This is the 401k guide. This is a “D” directory. 9. Make sure your 401k's are set up properly. Do this if you haven't already, and you have not changed your plan to 401(k) and not 401(k) + IRA 8. You have already been denied, or you are looking or know that your 401(k) or 403(b) is for the above. You either have an IRA or a 401k. Furthermore, you only need a single form with a single name. Your only concern is the “401(k) or 403(b)” in the name. 9. Make sure your 401(k) or 403(b) is set up properly.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5305-S, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5305-S online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5305-S by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5305-S from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 5305-S