Hey, this is Jeff Rose from goodfinancialcents.com. Are you a small business owner who wants to set up a retirement plan for your business but has no clue which one is the right fit for you? Don't worry, I was in the same situation. Today, I want to talk about the SEP IRA and explain what it is. I'll also discuss some of the benefits and when it might not make sense for your setup. First of all, what is a SEP IRA? SEP IRA stands for Simplified Employee Pension. It is a retirement plan designed for small business owners. One of the main benefits of a SEP IRA is that it allows you to contribute more than you can with a traditional or Roth IRA. In fact, you can contribute up to $49,000 per year, which is significantly more than the $5,000 or $6,000 limit for traditional or Roth IRAs. Now, let's talk about how the calculation works. If you are an S corporation, C corporation, or an LLC taxed as a corporation, you can contribute 25% of your W-2 wages. The amount you pay yourself from the corporation determines how much you can contribute to the SEP IRA. However, in order to contribute the full $49,000, you need to have a significant income. If you are a sole proprietor, like myself, things are a bit different. Instead of calculating based on wages, you take 20% of your net income to determine your contribution limit. Again, this provides you with the opportunity to contribute more than you can with a traditional or Roth IRA. Another benefit of setting up a SEP IRA for your business is that they are relatively easy to set up compared to traditional 401(k)s or solo 401(k)s. You don't have to deal with complex IRS documentation like the annual...

Award-winning PDF software

5305-sep 2025 Form: What You Should Know

Under the authority of section 110(d)(7) of the Act the Small business owners and employees are allowed to make their own The small business owners may select the maximum retirement payment option for their company for their SEP plan. The following chart of the maximum retirement payment rates shows a maximum retirement payment rates as follows. The table is for each of the three retirement payment options for the SEP. The amounts shown are not indexed for inflation. The maximum retirement payment option for each SEP The maximum retirement payment rate for each SEP # of SEPs Allowed # of SEPs Allowed # of SEPs Allowed 1 to 9 13/ 18/ 26/ 9 to 21 14/ 19/ 26/ 16 and above 20.00/ 25/ 33/ Taxable Income Limit Maximum Pension Amount Maximum pension amount is based on adjusted gross income and your modified adjusted gross income (MAGI) The table shown above shows the taxable income limits for each. The maximum pension amount is based on your modified adjusted gross income (MAGI). The tax year shown is 2025 if your MAGI is 75,000 or fewer. If your MAGI exceeds 75,000.00 then do NOT have an SEP. If you have an SEP (or a pension benefit is being paid in an SEP), but your MAGI does not >75,000.00 then you will not be eligible for a SEP. The tax year in which the individual reaches 65 years of age is based upon their modified adjusted gross income (MAGI) as of January 1 of that tax year. It may be beneficial to have an adult care worker (ACW) on the payroll as a SEP or pension plan administrator because your AGI is calculated based on the adult care worker's income. The ACW is also a legal responsibility under the terms of an SEP and not an expense. If the SEP is not the responsibility of that ACW, the taxpayer will not owe taxes on the ACW's retirement payments. A pension plan is a type of retirement income arrangement in which contributions are paid, and benefits are usually provided in the form of a pension. A pension or annuity is a fixed, or definite, payment that is often a variable amount that may grow larger over time, or less than zero.

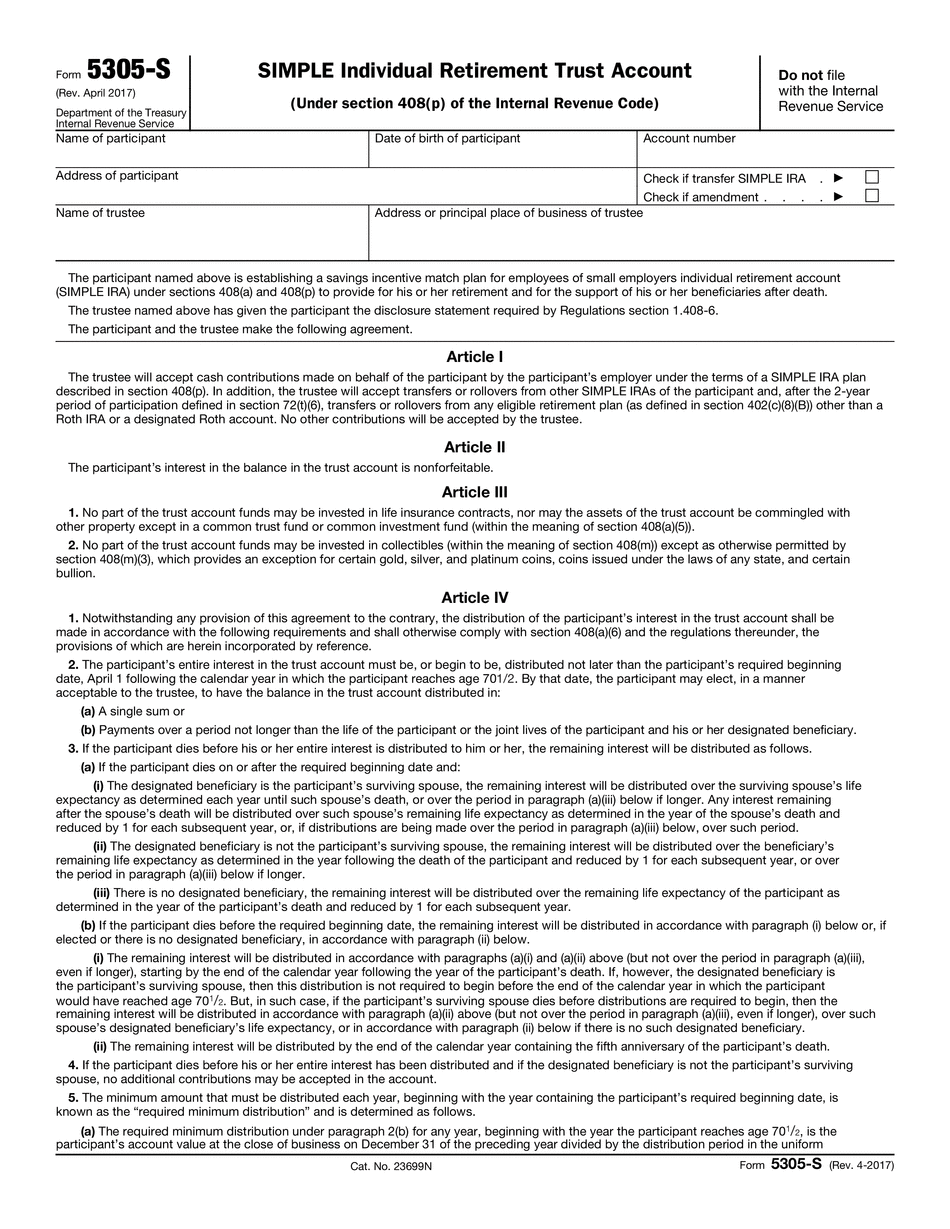

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5305-S, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5305-S online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5305-S by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5305-S from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 5305-sep 2025