Award-winning PDF software

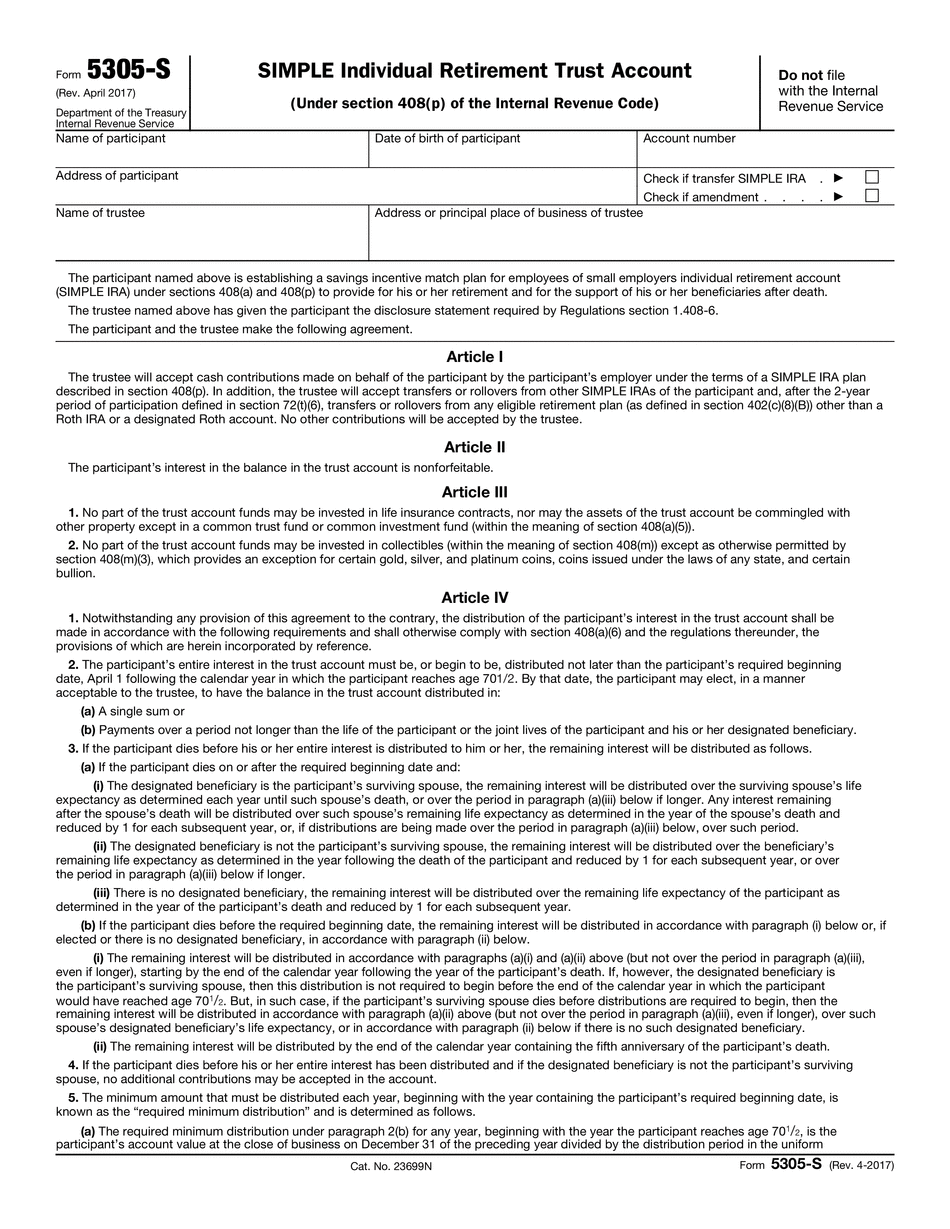

form 5305-s (rev. april ) - internal revenue service

The remaining Parts have been omitted because the agreements are not intended for those circumstances. The Model does not identify any provision to establish a tax-exempt trust, and thus the Trust Code prohibits tax-exempt trusts from holding any financial transactions as part of their business for which section 408(p) applies. See section 408(l). In addition, this Part does not satisfy the requirements of the Model C. §§ (3)-(5). There is no exception to this rule for §§ (e)-(e) under which a trust may accept payments from an issuer or transferee by virtue of an agreement between a trust and the issuer or transferee. For example, this Part is invalid if, based on the facts as described below, the trust is not “tax-exempt” as defined in section 151(d), and therefore does not qualify for the tax exemption as a pass-through entity. 2. Trust Documents The only trust instrument.

form 5305-s "simple individual retirement trust account"

How Can I Help You ? If you found this resource helpful, a share is enough! If you found this resource useful, a contribution via PayPal is also enough.

Justia :: form 5305-s simple individual retirement trust account

The Federal retirement plans available for the American citizens and residents and eligible for tax benefit is listed under the section of Taxation on webpage. The National Retirement Association. What is the National Retirement Association ? The National Retirement Association (NRA) is a non-profit organization dedicated to ensuring the economic security of its members. It is a service agency that was opened on March 1, 1948, as National Association of Retirement Societies (ALSO), for its role as the voice of the members. Since its inauguration, it has remained active, developing and operating various retirement plans in order to make them accessible to the public. It currently has 821,000 members or associates and has approximately a billion in financial assets and a billion in pension assets. This is the largest association of American employees, representing some million people. What is a Pre-Tax IRA or Traditional IRA ? A Pre-Tax IRA or Traditional IRA is a.

Form 5305-s, simple individual retirement trust account : under

For example, you can get this spreadsheet of all 401k plan rules from the official IRS website. 3. The Retirement Income Tax Act of 1974 (TI GTA) A single taxpayer in the early retirement years is required to calculate his income for retirement. In order to calculate the required amount of Social Security benefits, he must calculate “gross annual income”. This is generally found by multiplying the annual Social Security benefits by 2,000 (the current maximum benefit amount for single individuals) at the 61,000 maximum benefit level. 4. Internal Revenue Code Section 401(a) : a contribution to a 401k plan is required to be “contributions not includible by reason of section 401(a) and section 403(b) of the Internal Revenue Code.” 401k contributions are deductible by the employer, but not individually. This means that your pre-tax income at retirement is subject to Social Security income taxes. In 2016, the tax rate is % but.

finally issues forms to be used to establish the simple-ira

What you need to know about these documents: The IRS will collect the tax due, but the IRS does not offer refunds due to delays in processing. You need to file Form 540-SA, and Form 540-S with your local county auditor to receive a refund of the amount owed. You can download these forms from the Revenue Procedure 2017-16. All of these forms, including the Form 540-SA, are available on the IRS Download Center! The IRS may ask about any assets you have or intend to roll over to. If you are a non-resident or international investor you must file a separate form called Form 4868 with your financial institution and IRS. See IRS Form 4868 for information. Important Links on this website IRS Form 540 — SAN IRS 5305-S (2018 and earlier Forms) IRS Form 4868: SAN IRS Form 540-S: SAN IRS Publication 529: SIMPLE IRS Publication 550: SIMPLE Income Tax Schedules IRS Publication 491: SIMPLE Tax IRS Form 4902: SIMPLE.