Award-winning PDF software

Form 5305-S for Eugene Oregon: What You Should Know

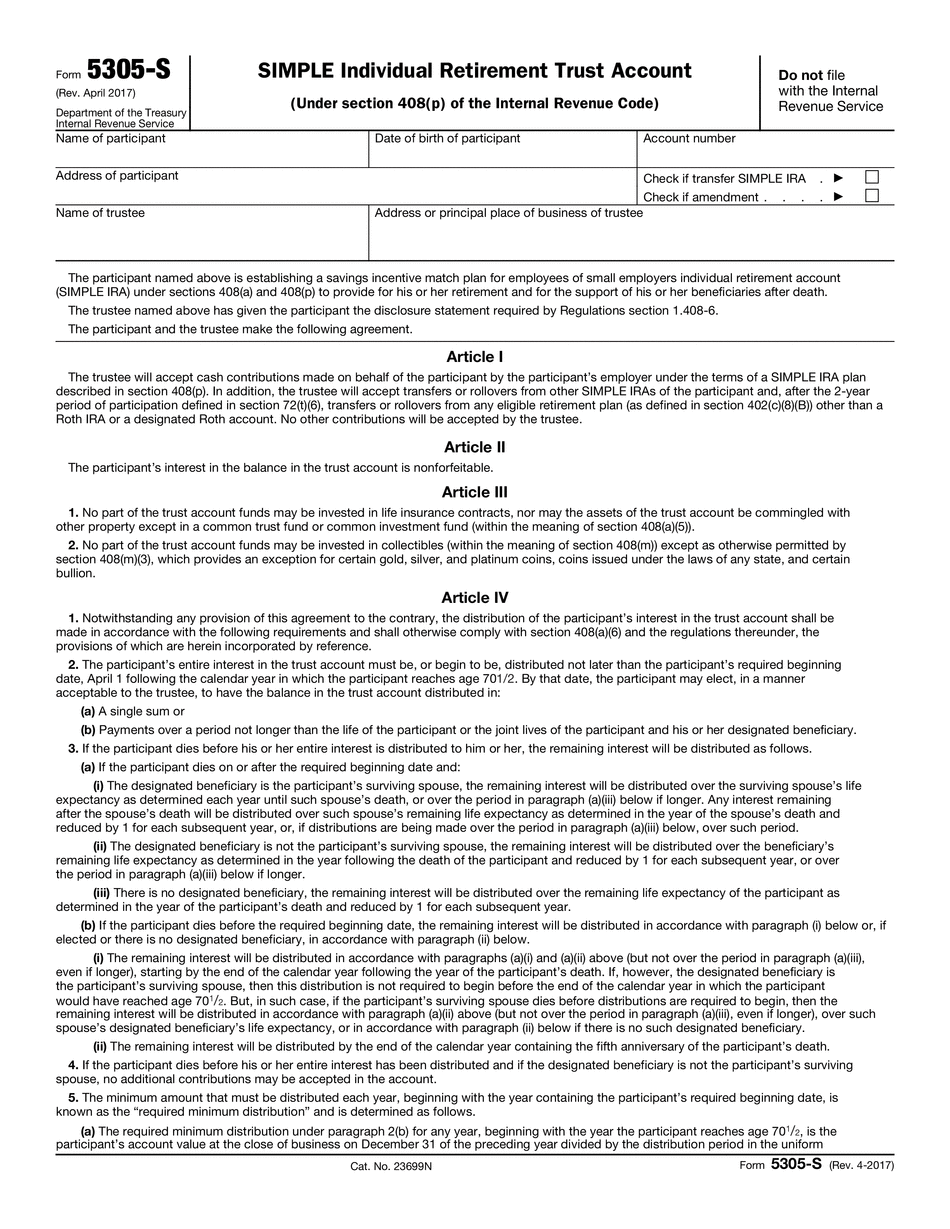

Form 5305-SIMPLE Simple Individual Retirement Accounts form. This form allows you to designate an IRS-approved retirement plan, for the purpose of including your income with your regular paychecks for all years of the Plan. It will also qualify any amount you contribute as taxable income, and provide you the ability to qualify for a tax-free retirement account, like a Roth IRA. All this as a form of income tax deduction, so you don't pay any income taxes on that 5,000 of your contribution that you just spent. This makes retirement savings accounts (i.e. SIMPLE IRAs) the preferred choice for most people. Form 5305 Simple Tax Deduction. With the Internal Revenue Service. The IRS Simplifies Form 5305 for Individuals, and makes this the only way to file the form if a trustee cannot be found. You have no choice. All IRS forms are online. The IRS Simplifies Form 5305 for individuals. The IRS Simplifies Form 5305 for Individuals. SIMPLE IRA FAQ: What Does “Roth IRA”? You have to be paying more into the IRA now to earn the right to have it tax-free. — John Form. This form will help you set it if it's been done already. Form 5605-SIMPLE IRA: SIMPLE IRA (Single or Joint) Form 5605-SIMPLE Individual Retirement Accounts; IRA. What is a SIMPLE IRA? It's a regular IRA with a very simplified way to set it up. It's a way to get money for retirement and save more money. With some restrictions, if someone has not contributed to a SIMPLE IRA, he may be able to contribute to one. If they can contribute, that person can then participate in a SIMPLE IRA. — Daniel Forms. SIMPLE IRA and Roth IRA. With Roth IRA you are required to make some minimum contributions into one over and over and over again, while having no limit over and over again for contributions to one SIMPLE IRA or any IRA, if eligible, with a Roth to begin with is a new IRA. With a SIMPLE IRA all one has to do is make up the money by taking out a bank loan or borrowing it from someone who is not a Roth IRA owner. SIMPLE Roth IRA. With a SIMPLE IRA one who was not previously contributing to an IRA is eligible to open one within a few months.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5305-S for Eugene Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5305-S for Eugene Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5305-S for Eugene Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5305-S for Eugene Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.