Award-winning PDF software

Form 5305-S online Bellevue Washington: What You Should Know

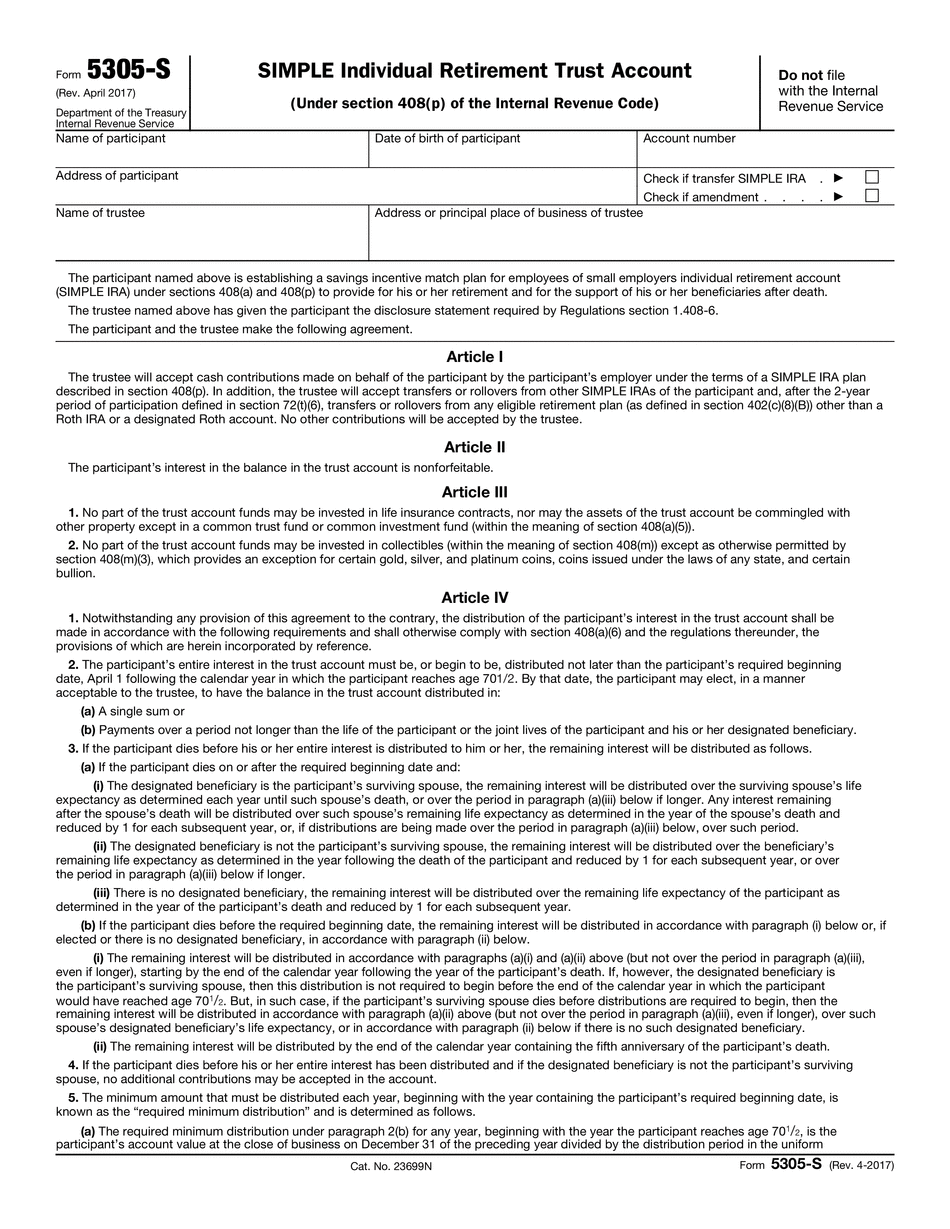

The beneficiary's name and mailing address must appear on the beneficiary statement. Be the first to know. No one covers what is happening in our community better than we do. And with a digital subscription, you'll never miss a local story. SIGN ME UP! St. Louis, MO • State Farm — St. Louis • State Farm Mutual — St. Louis • State Farm Insurance — St. Louis In order to be eligible for a tax deduction for your contribution, you must be a citizen of the United States and any of the following apply: The trust must have been established before April 17, 2013, for which tax year the contribution occurred, with any rollover after June 9, 2013, or for which the contribution occurred in the first year a direct trustee has been appointed. One trustee is required. The trustee serves in an advisory capacity to manage the trust during an individual's lifetime. The trustee's responsibilities are: Understand the trust's specific provisions to determine if there is a legal requirement for the trustee to meet. Be legally authorized to make the contribution. Meet at least one of the following: Meet the annual reporting requirement as defined in IRS Publication 550, Contributions To Individual Retirement Accounts, by the close of the trust's 10th anniversary. The trustee must submit a signed statement to be certified by the executor of the person who owns the trust, or the executor's designee, attesting to that fact. Understand that the trust is not a qualified retirement plan. Understand that an IRA can only be a qualified retirement plan if you are a non-U.S. citizen and the trustee is an American citizen. Actively manage the IRA. In the event any trust funds have been invested in a qualified plan, the trustee must retain up to 25 percent for investment of the account in the qualified plan. Otherwise, the account can be invested only in money market funds, Treasury Inflation Protected Securities, and certificates of deposit. If you invest in a qualified plan and the IRA portion of your 401k contribution is greater than the tax exclusion, you must file Form 6166 when receiving your first distribution, otherwise you have to treat your 401k contributions for all years it is in effect as income. This form must be reported as an income source. Under the law, the trust is considered to be a qualified retirement plan for this purpose only, although it is treated as a nonqualified plan with respect to any contribution that benefits from the tax exclusion.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5305-S online Bellevue Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5305-S online Bellevue Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5305-S online Bellevue Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5305-S online Bellevue Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.