Award-winning PDF software

Form 5305-S online Stockton California: What You Should Know

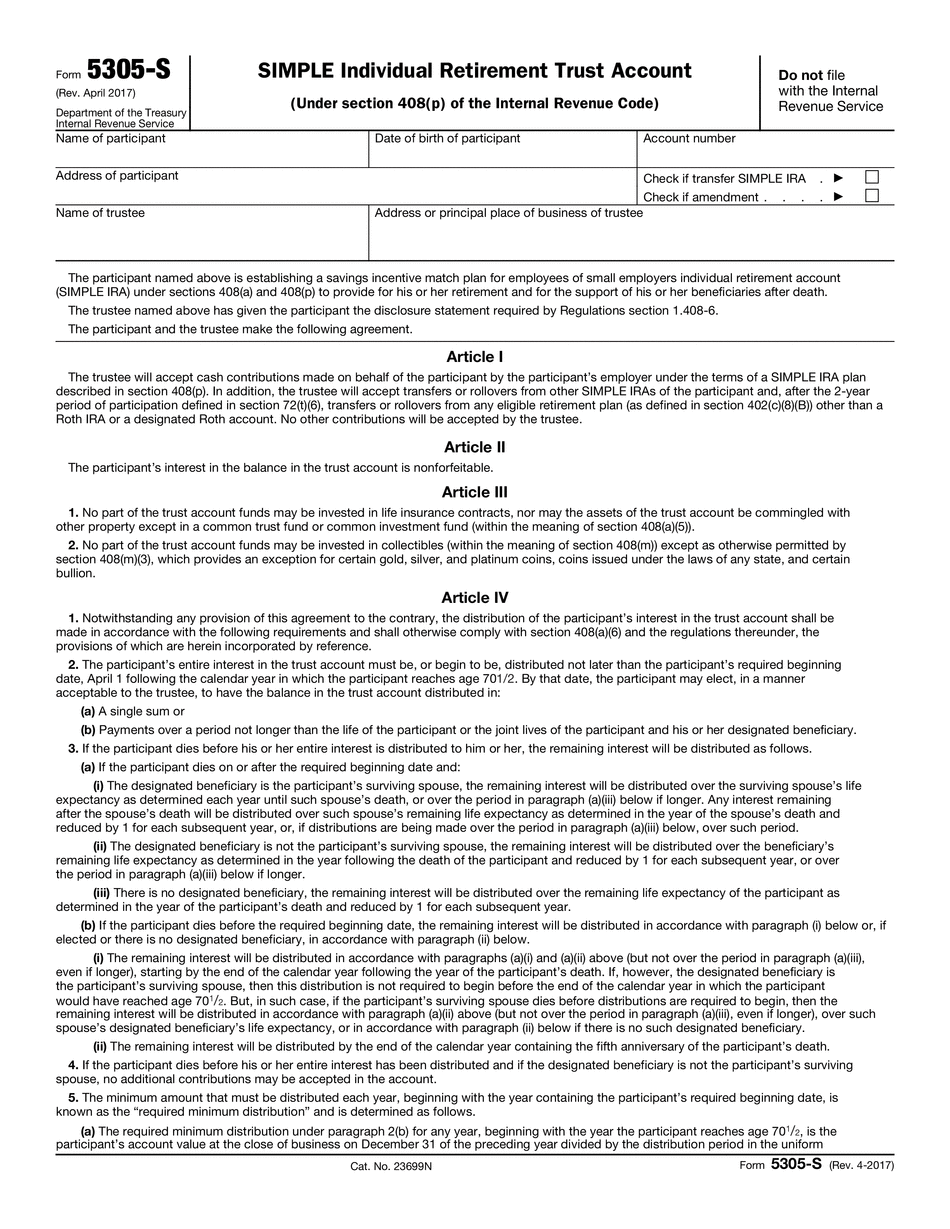

The taxpayer must complete Form 1040 The filer must complete Form 5205 (PDF). To File Form 5305 and for all subsequent reporting periods and forms. The Trust must comply with certain provisions under section 3707 of the Internal Revenue Code. The trust agreement must be made on paper. The agreements and trust rules may be revised or changed at any time. Note: The IRS does not recommend filing Form 5305-S (for all reporting periods). The filer must be employed at the time of filing the trust return. The filer must be an employee, officer, or director of a public company if the company (i) made an election by its articles of incorporation to have these agreements as its bylaws; or (ii) submitted a written proposal to the board of directors that provides specific instructions to the company (if the company) regarding these arrangements between its officers and directors and the Trust before the end of 2014. If you plan to provide this guidance to the corporation, and you do not know how the company must amend its articles and the trust agreement regarding this arrangement in order to ensure the company is in compliance, it is recommended that the corporation submit the proposed amendments to the committee on corporate governance in 2014. (If a company fails to propose amendments to its bylaws, then it may be at risk of being found in failure to satisfy the requirements to file a tax return.) The filer must be the legal owner of the trust when filing Form 5305-S. This document will show whether the trust is subject to section 408(a) or the other section 408(p). (For more information on section 408(p), see Internal Revenue Bulletin 2013-33, which is on-line. The most current version on IRS.gov.) For certain transactions, the filer must have timely acted as trustee. The filer must provide any additional information required by the trustees. For example, a filer must also certify that the Trustee has received instructions from the trustee on all aspects of the trust relationship and that the Trustee has taken all the steps consistent with Section 408(m)(7) of the Internal Revenue Code as they apply to the trust relationship. Payment of a claim for refund to an account under this trust must be made from the trust. If the trust is a qualified trust, the payment is subject to the provisions of Section 877(k) of the Internal Revenue Code.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5305-S online Stockton California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5305-S online Stockton California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5305-S online Stockton California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5305-S online Stockton California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.