Award-winning PDF software

Mesa Arizona Form 5305-S: What You Should Know

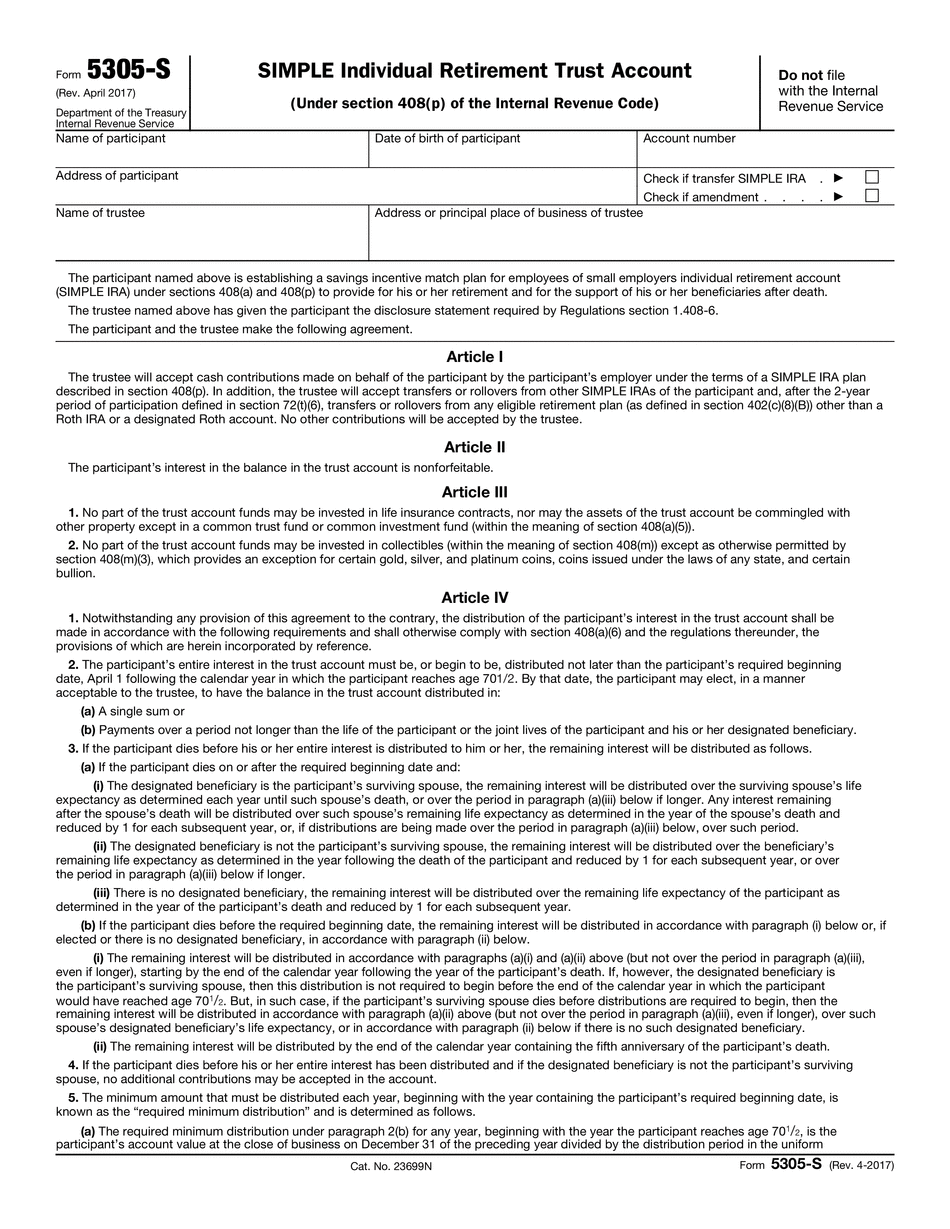

The IRS has a new form in the mail for you to be ready for the March 2025 FACT. For more than twenty years, the IRS has sent out new form Facts to businesses, with the deadline on March 15 of each year. The FACT provides guidance on what to file and is the basis of the employer tax form 1099. What's the new form FACT? The new Form 5305-SIMPLE, Savings Incentive Match Plan for Employees of Small- Simplified IRA, SEP-IRA is designed for employers to offer employees a non-taxable, self-directed IRAs for use after retirement; and, the FACT is the basis of the federal tax. It will be received by payroll on or before March 15 for employers who are not registered with the IRS to file forms 1099 with the IRS. Learn more about Form 1099 from The Internal Revenue Service. We provide business opportunities & business planning solutions to help your business flourish. It's all about your return. Your return to success. The only one. Your return to success. Learn more on IRS.gov (you can find it by searching the word “IRS” on IRS.gov) For more on SEP-IRA's in business tax solutions visit The Individual Retirement Account or see the link for the SEP-IRA's SEP-IRA For Business Tax Solution. “The IRS sent me a letter regarding me including a small amount of cash in my employee box to receive one-time payment after tax, a form 1099” “I thought it will just be paid to me from my company” “Well, I can't wait until I see your money!” “If that's true, let me know. Can you just send me a pay stub showing how much was paid into my account?” “The IRS wants you to pay this money directly to yourself…the way it should have been paid? I mean you could at least do that on paper and sign it?” I have had these reactions from some of my contacts who do not work for a company. Now in my opinion, the best option to avoid these potential misunderstandings is as simple as a very nice, personalized copy of my business tax form to give to them. You can read more from the link on the link below, which addresses those who don't pay taxes on the small amounts of money they receive.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Mesa Arizona Form 5305-S, keep away from glitches and furnish it inside a timely method:

How to complete a Mesa Arizona Form 5305-S?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Mesa Arizona Form 5305-S aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Mesa Arizona Form 5305-S from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.