Award-winning PDF software

Printable Form 5305-S Oxnard California: What You Should Know

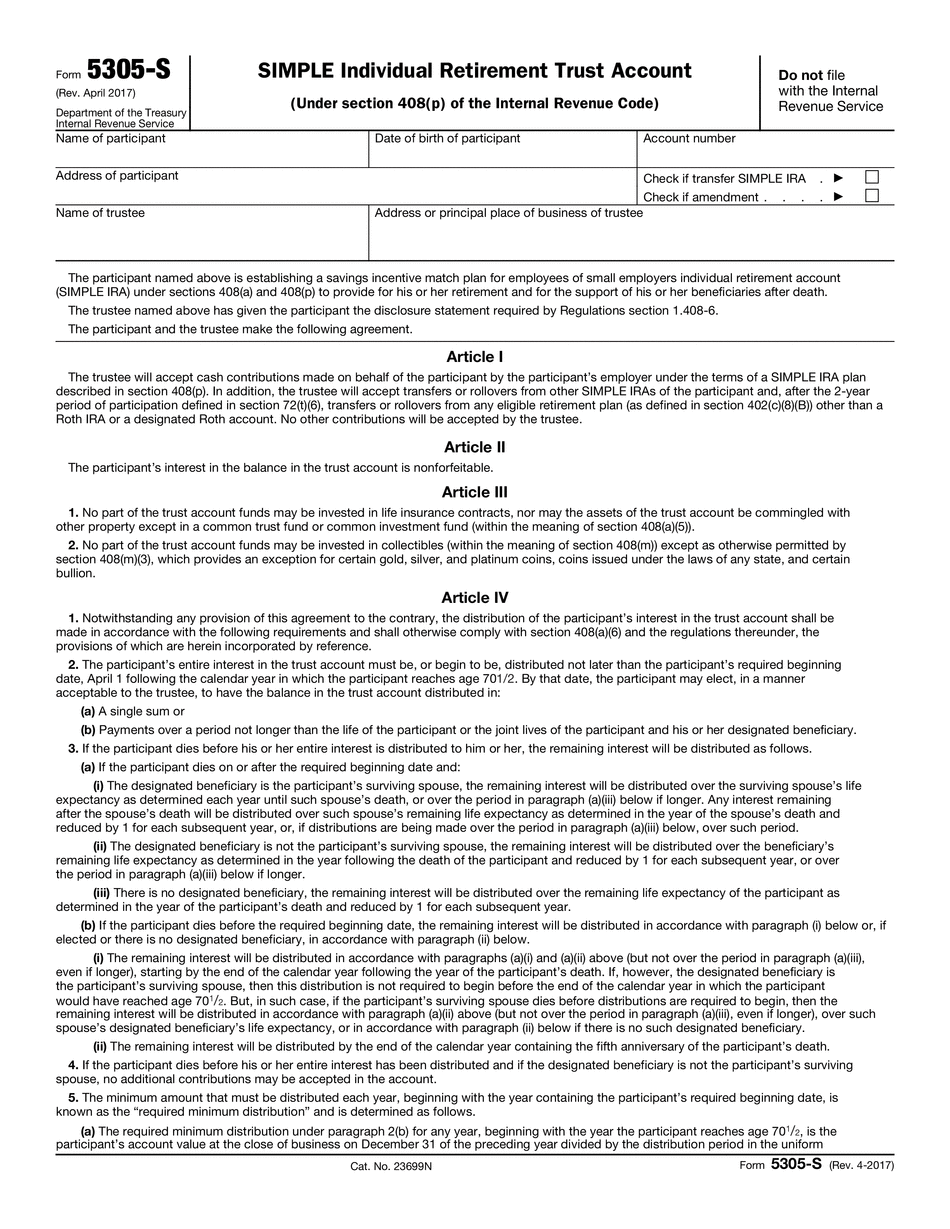

Online services by California DMV — Get DMV services now and pay your bill up to 60 days before due date or at the time of registration! (ii) a statement of contribution and a signed copy of a legal agreement signed by the participant and the participant's designated beneficiary which provides notice of the participant's contribution to the IRA; ``(d) a statement that he or she intends to contribute to the IRA, which is set up for the participant's benefit or under the guidance of a tax professional; and ``(e) the participant's account number Form 5305-S (SIMPLE IRA/SA) (1) The contribution to an IRA or other qualified deferred arrangement is based only on income earned during the participant's employment while in the United States, ``(2) The participant's balance in the account is reduced by the amount of any contributions previously made to the account. S-1 (1) A participant may only make one contribution to an IRA. No more than 50% of the participant's earnings during the three taxable years at any taxable period may be contributions to the IRA in any year, and no more than 50% of earnings during the period may be included in the computation of income earned during the taxable year in which the account was opened. In lieu of the 50% contribution limit, at any time while the participant has attained age 59 ½, the participant may choose, at his or her own election, to receive an amount equal to 50% of the total contributions made to the IRA to the participant during the three taxable years immediately prior to the taxable year in which the account was opened. A participant who elects this option may not make any further contributions to the IRA during the taxable year. This is in contrast to an employer-sponsored retirement program, the 401(k)-type plan, and the 403(b) plans, whose contributions are subject to the 50% contribution limit. S-2 (2) The participant pays for all administrative, accountancy, and other expenses related to the development and maintenance of his or her plan, and pays the balance due to the trustee for the benefit of the participating IRA beneficiary, with interest based on the under-funded status of the trust account. For taxable years prior to 2013, interest is calculated at a rate equal to the federal funds effective rate (currently 3.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 5305-S Oxnard California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 5305-S Oxnard California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 5305-S Oxnard California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 5305-S Oxnard California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.