Award-winning PDF software

Form 5305-S for Salt Lake Utah: What You Should Know

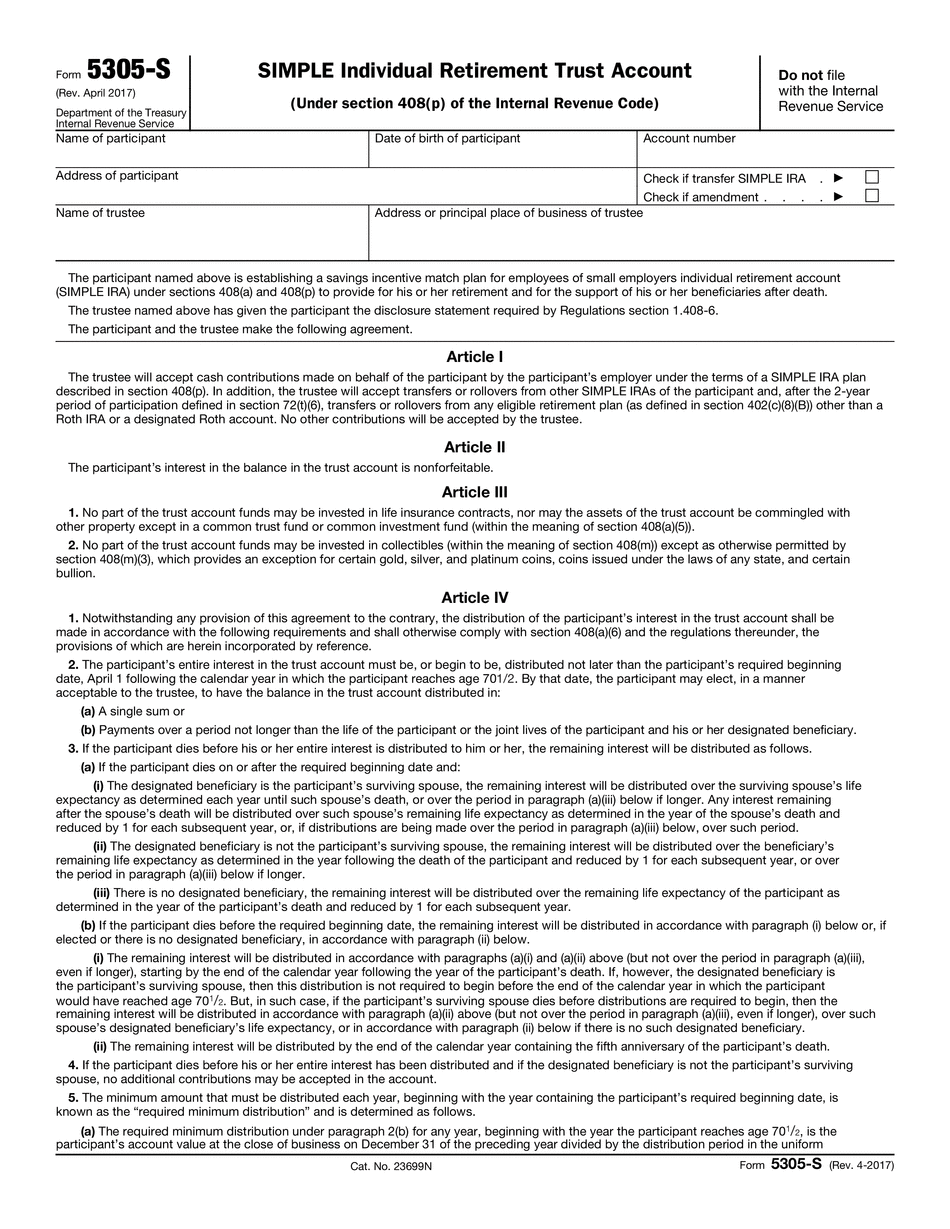

Save and store these forms for reference. These include the form 5305-S, savings incentive match for employees of small Businesses. Form 5305-S (for individual or limited partnership) If filing together as 1 spouse or as more than 1 spouse, have all of your employer's employees sign Form 5305-S for individuals, Form 5305-S for partnerships, or both. Form 5305-S forms have a special “individual” line, whereas the partnership forms do not have one. Therefore, Form 5305-S forms are simpler to fill. If signing both Form 5305-S, Form 5305-SM (individual retirement accounts) and Form 5305-S (savings incentive), the IRS will allow you to select a plan which will match the amount of taxes you withhold on contributions to your retirement savings accounts, including 401(k)s, 403(b), and 457 plans. The IRS will NOT accept paper forms, so keep forms in a safe place, such as a computer. Be aware that the IRS will withhold a 10 percent penalty tax on distributions of amounts deposited on Form 5305-S for 401(k)s and 403(b), when the account owner does not have a filing status of “Single” or “Married filing separately.” For more information on the rules in place and a list of approved plans for retirement savings accounts, consult the Guidebook 5305-SIMPLE (Form 5305S). The amount that you give in Form 5305-S is up to you. For more information (and additional guidance on your situation), please contact your local Small Business Development Center. This list is provided by the State of Utah as a tool for Utah small business owners.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5305-S for Salt Lake Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5305-S for Salt Lake Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5305-S for Salt Lake Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5305-S for Salt Lake Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.