Award-winning PDF software

Form 5305-S AR: What You Should Know

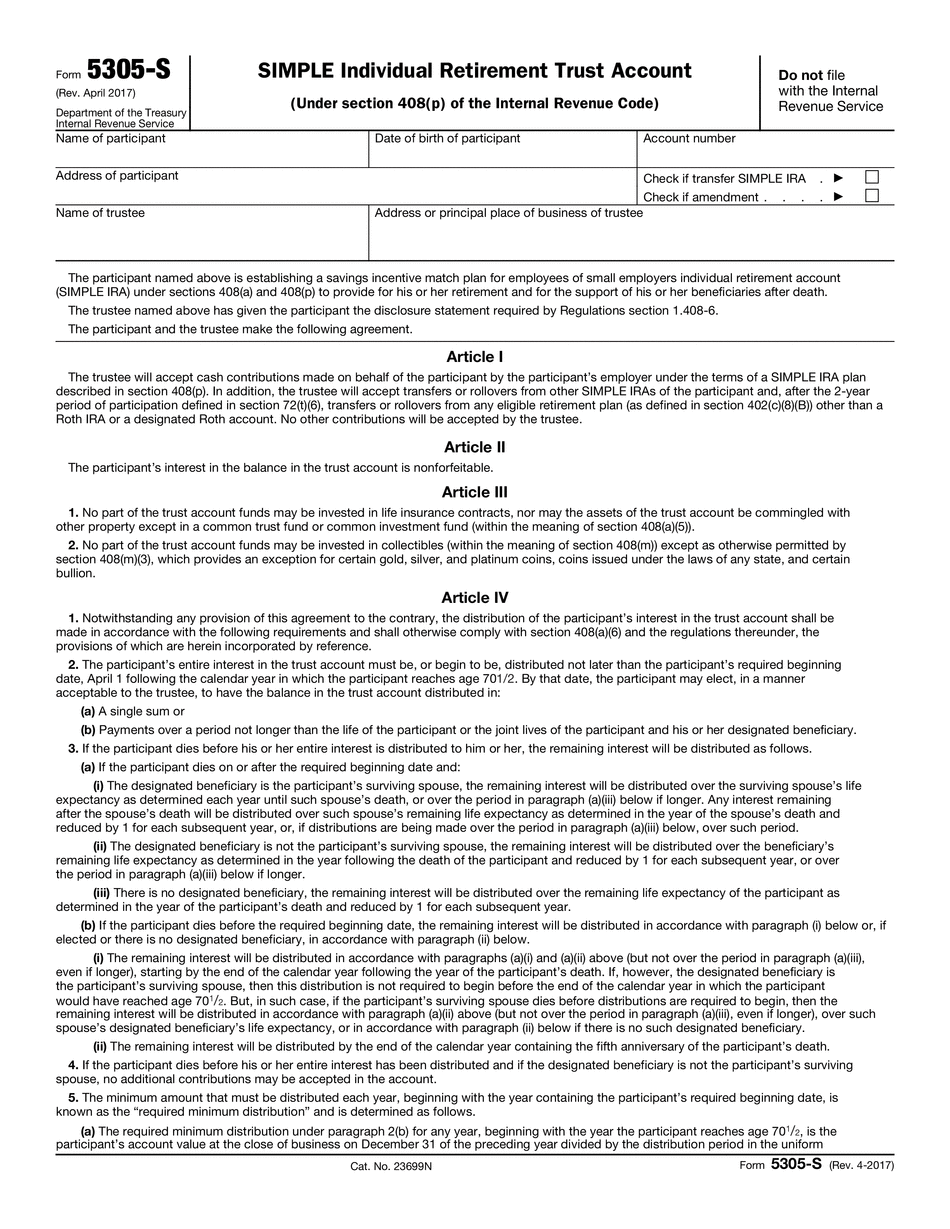

Form 5305-SIMPLE IRA (Rev. October 2017) — IRS There are multiple versions of SEP retirement plans for small businesses, see for a list of these. SEP IRAs for Small Business SEPs are limited to employee contributions and are generally not accepted by SEPs, 401K plans or IRA plans for the provision of matching contributions. IRS Publication 590, Contributions and Benefits, for small employers — IRS Publication 590-B, Contributions and Benefits, for the Pension and Annuity industry Federal law restricts your participation in a pension plan if it provides for employer Matching Contributions, or more than one hundred percent of your compensation, must be paid in a contribution annuity. A contribution to a SEP would not count toward the pension annuity requirement. You can make SEP contributions directly to your retirement plan. What is an Employee Retirement Income Security Act (ERICA) Qualified Plan? An ERICA qualified plan must: -Be established by you (or a corporation you control) within the ordinary course of your business for the purpose of providing retirement and profit-sharing benefits to employees or their beneficiaries -A reasonable contribution to the plan (not including contributions made to a SEP) must be made by each participating employer each year for the benefit of all the participants of the plan in proportion to the number of employees who participate in the plan, and -The benefits to be provided must consist of at least the benefits to which participants of the plan are entitled under the terms of the plan. See What are the rules for ERICA Qualified Plans? Under “How are Qualified Plans Different from 401k Plans and IRAs?” The requirements for an ERICA qualified plan can be met by using IRAs or 401ks. Where Should I Use SIMPLE? SEPs, 401Ks and IRAs can be implemented as standalone plans or as part of a separate plan. Use Form 5305-SIMPLE to determine if the plan is an ERICA qualified plan and to establish the appropriate contribution limit for the plan. For example: A plan at home for company employees. A plan in the company's office or building. A plan where employees have to sign each paycheck. A plan in the company's headquarters or another building owned by the company.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5305-S AR, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5305-S AR?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5305-S AR aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5305-S AR from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.