Award-winning PDF software

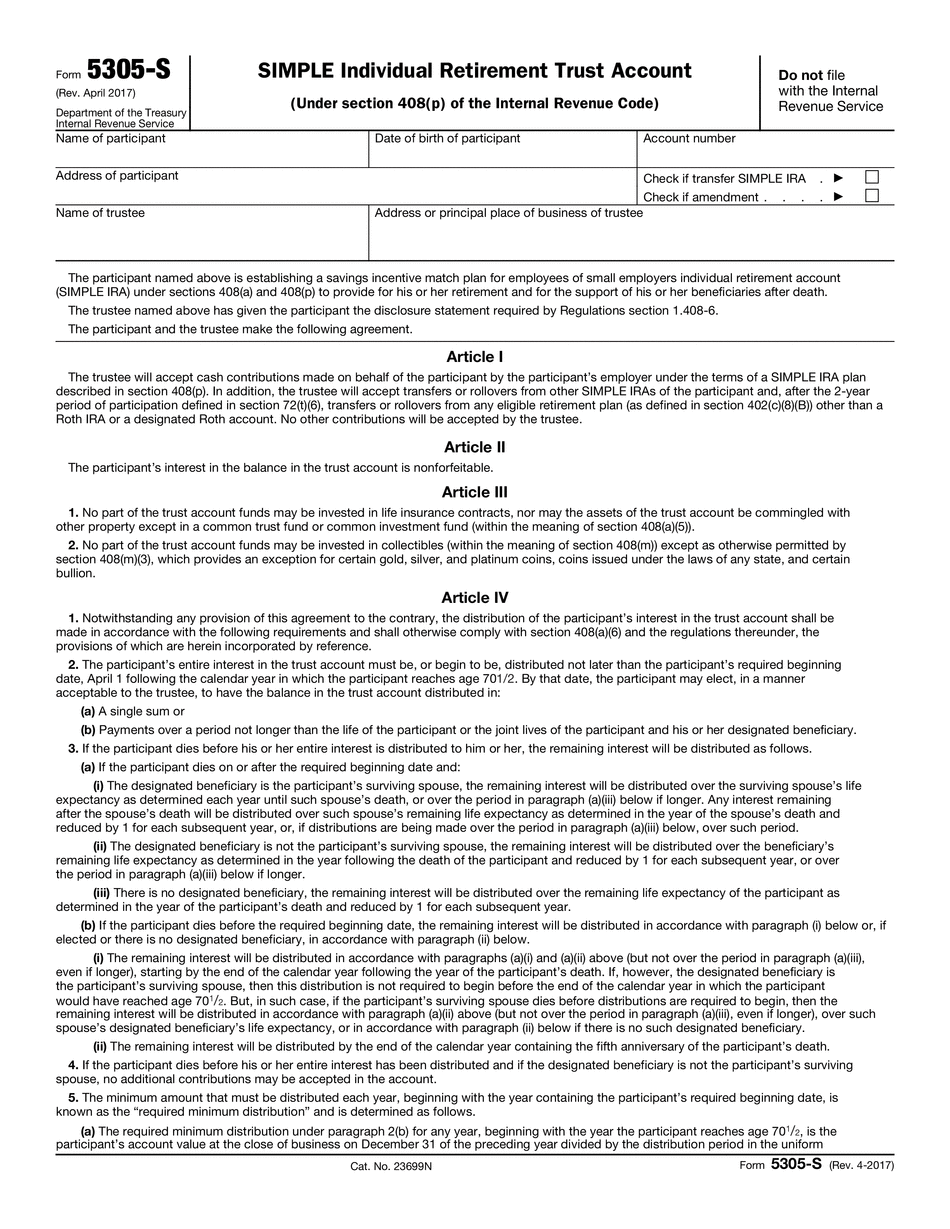

Printable Form 5305-S Rhode Island: What You Should Know

Mail the confirmation e-mail). If you do not provide your Social Security number to have your income excluded from gross income on Form 8938, you will not qualify for the federal income tax benefit. If you are paying a balance at the end of the year, the employer must report the amount it paid on your Form 8938, and you may qualify for the exemption if your annual salary is below the filing limit for your filing status. Income limits apply for the following forms of income: FICA (or FTA) tax: Federal Insurance Contributions Act (employer-paid) Social Security: Federal and State programs Social Security is a Federal and State program. When you are employed or self-employed, all of your income is subject to Federal and State taxes. Federal Income Taxes are based on the full amount of your earnings. Income Taxes are deducted from your compensation and reported on your Form W-2. For more information about Social Security taxes, and for a more detailed explanation of what's meant by “earned income,” see my Social Security webpage. Earned income: Income that you receive from any activity that requires the physical or mental exertion of a person, or the product of two or more activities of a dependent nature performed by the same person. In other words, income earned during the taxable year is reported on your Form 1040. If you have earnings from other sources, your amount will be reduced by the amount reported on your Form W-2. This reduction is figured on Form 1040 and reported on line 37. For more information, visit my page about “Self-Employment Taxes” and my personal Income Tax FAQs for the Self-Employed. Payments of dividends, interest, royalties, or profits from the sale or exchange of securities are not taxed. Also, if you are under age 65 and not exempt from Social Security, you may receive a social security benefit for any earnings from self-employment from any of the programs set up to replace old-age payments, Social Security disability, and Medicare. The amount of the benefit is deducted from your taxable income and is treated as personal income. Payments you've made to an IRA are taxed at 10%. The rules and benefits for IRA distributions, along with other information about IRA income, can be found here. Forms 5115-S (Warrant or's Election) — T.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 5305-S Rhode Island, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 5305-S Rhode Island?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 5305-S Rhode Island aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 5305-S Rhode Island from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.