Award-winning PDF software

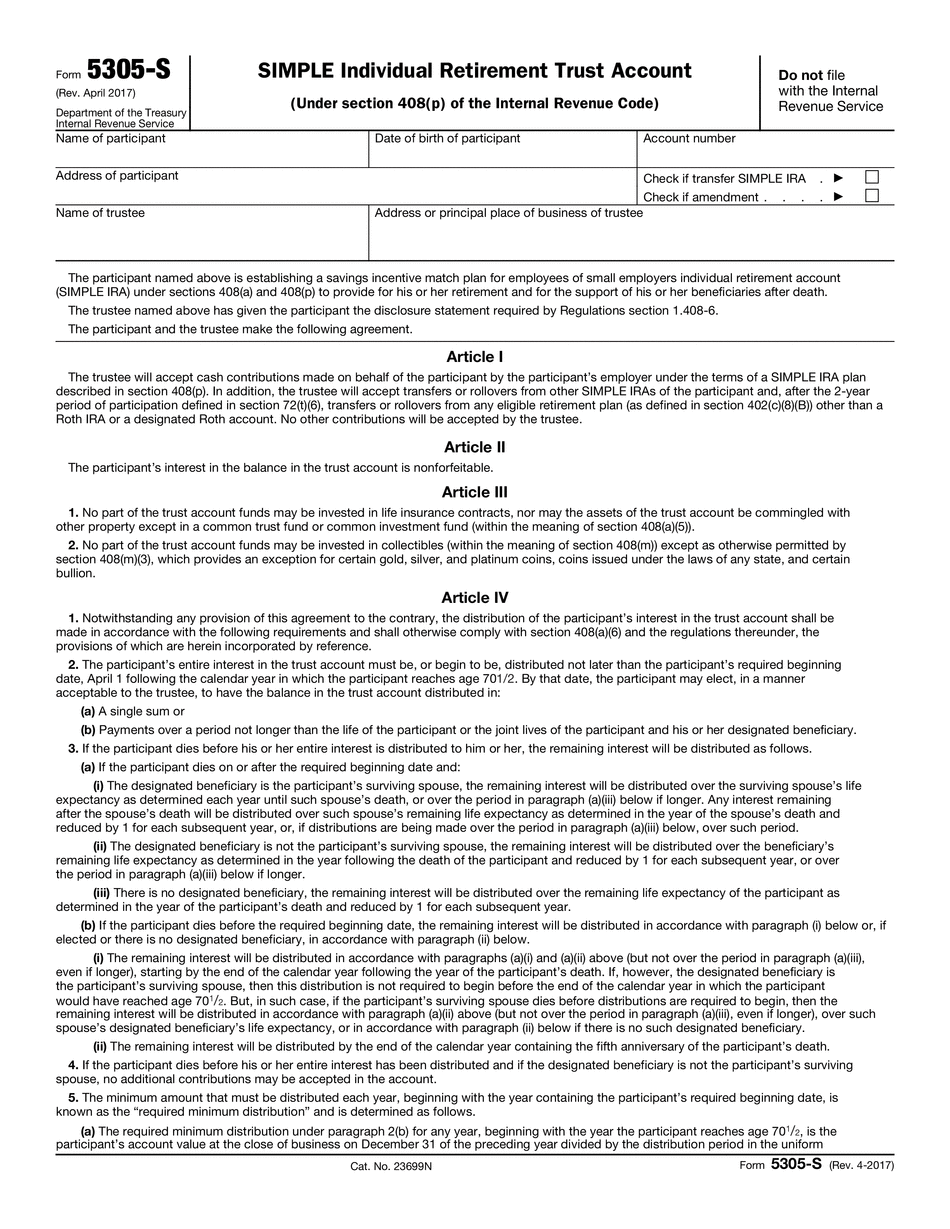

California online Form 5305-S: What You Should Know

You must be at least 62 years of age (or must be emancipated under California law) to be the Depositor. The Depositor declares that he or she is establishing his or her own personal estate, and that the Depositor does not have a spouse or close intimate in the U.S., is unmarried, and has no dependent children, or, where the Depositor is married or emancipated, is a surviving spouse or emancipated child. You will also attest to all the following facts: 1. The names of all the Depositors will appear on the trust. 2. The names of all the Depositors on the trust account of each IRA Account (hereinafter referred to as Retainer) will be shown on the trust account, with the date that the Depositor attains the age of 60 years, and 3. The address and telephone number of the Depositor or a designated agent will be shown on the trust account, and the address of the Depositor's principal place of business and the telephone number of its principal business telephone number. You will attest on the trust account to the following facts: You are the owner of all the Depositors' IRAs It is not your purpose or intention to give or receive, directly or indirectly or for any other purpose and with any influence whatsoever, any money, property or financial advantage. The Depositor will not have any interest, direct or indirect, in ‹Retainer or the IRA and will not use ‹Retainer in any way, for any purpose, other than the operation of the IRA and the Depositor will not have a direct or indirect pecuniary interest in or relationship with another person, other than the Depositor, except that, in respect of the IRA Account with a ‹Retainer account, your share of the Depositor's share of any interest in the assets in the account shall be 100,000 plus accrued interest under the terms of the trust. You must not have any liability of any kind against the Depositor, the IRA Account, or any other third party for the operation of the trust. You must not be in the position to be reimbursed by the Depositor for any payments made from the trust.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete California online Form 5305-S, keep away from glitches and furnish it inside a timely method:

How to complete a California online Form 5305-S?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your California online Form 5305-S aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your California online Form 5305-S from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.